Hours after the US Securities and Exchange Commission (SEC) had issued a Wells notice to Paxos, the issuer of BUSD, the company was reportedly told to stop issuing the stablecoin.

New York regulator orders Paxos to stop new BUSD minting

Changpeng Zhao, the CEO of Binance, broke the news on Feb. 13 after being informed by Paxos.

Paxos is regulated by the New York State Department of Financial Services (NYDFS) and claims to be compliant with US laws. It is reportedly taking this step following an order from New York regulators.

It was revealed that Paxos received a Wells notice from the SEC earlier. The agency claims BUSD is unregistered security, compliant with the criteria laid out under the Howey Test. The Howey Test lays down aspects that qualify an asset to be classified as a security and placed under SEC’s regulations.

By receiving the Wells notice, the stablecoin issuer was supposed to explain, in writing, why the agency shouldn’t go on with an enforcement action, in this case, a lawsuit.

The Wells notice has not been made public, but its content is well-known to people aware of what’s happening inside Paxos.

There has been no official comment from Paxos on this development. At the same time, the NYDFS is yet to issue the statement.

What’s publicly known is that Paxos issues BUSD under the Binance brand. Binance is the world’s largest exchange by client count but is not directly associated with Paxos. Paxos takes complete control in minting BUSD.

BUSD market cap decreasing

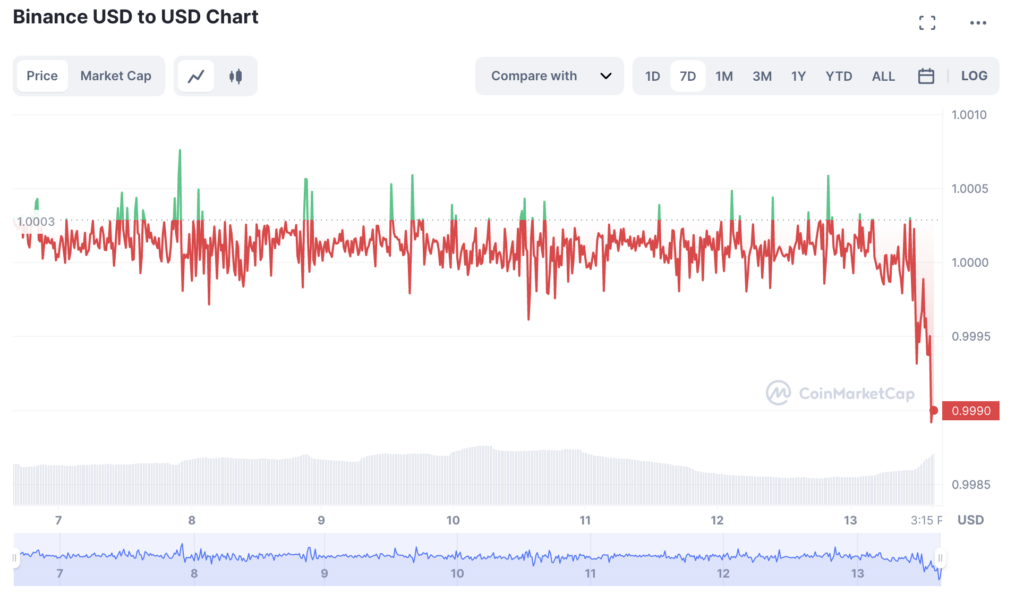

As of writing on Feb. 13, BUSD was the third largest stablecoin by market cap with a circulating supply of $16.1b. The stablecoin also trades below the $1 parity, with the USD at $0.9995.

The slight de-pegging could, following the announcement, be due to outflows to other stablecoins, including USDT and USDC.

How this could impact the stablecoin dynamics across the board is yet to be known.

Even so, Changpeng Zhao expects “BUSD’s market cap to continue decreasing,” and Paxos will continue to service the product, managing redemptions.