According to Trader Capo of Crypto, the failure of most altcoins to follow bitcoin’s recent surge past $25,000 suggests the possibility of market manipulation or overvaluation of BTC.

This, coupled with the fact that most altcoins remain in their resistance zones, leads him to believe we could see new market lows soon. Capo also suggests that this could also be part of a looming financial crisis.

Capo emphasizes the importance of being aware of potential market manipulation and cautiously approaching investing in cryptocurrencies. It’s good to have a plan and to stick to it, even during times of volatility.

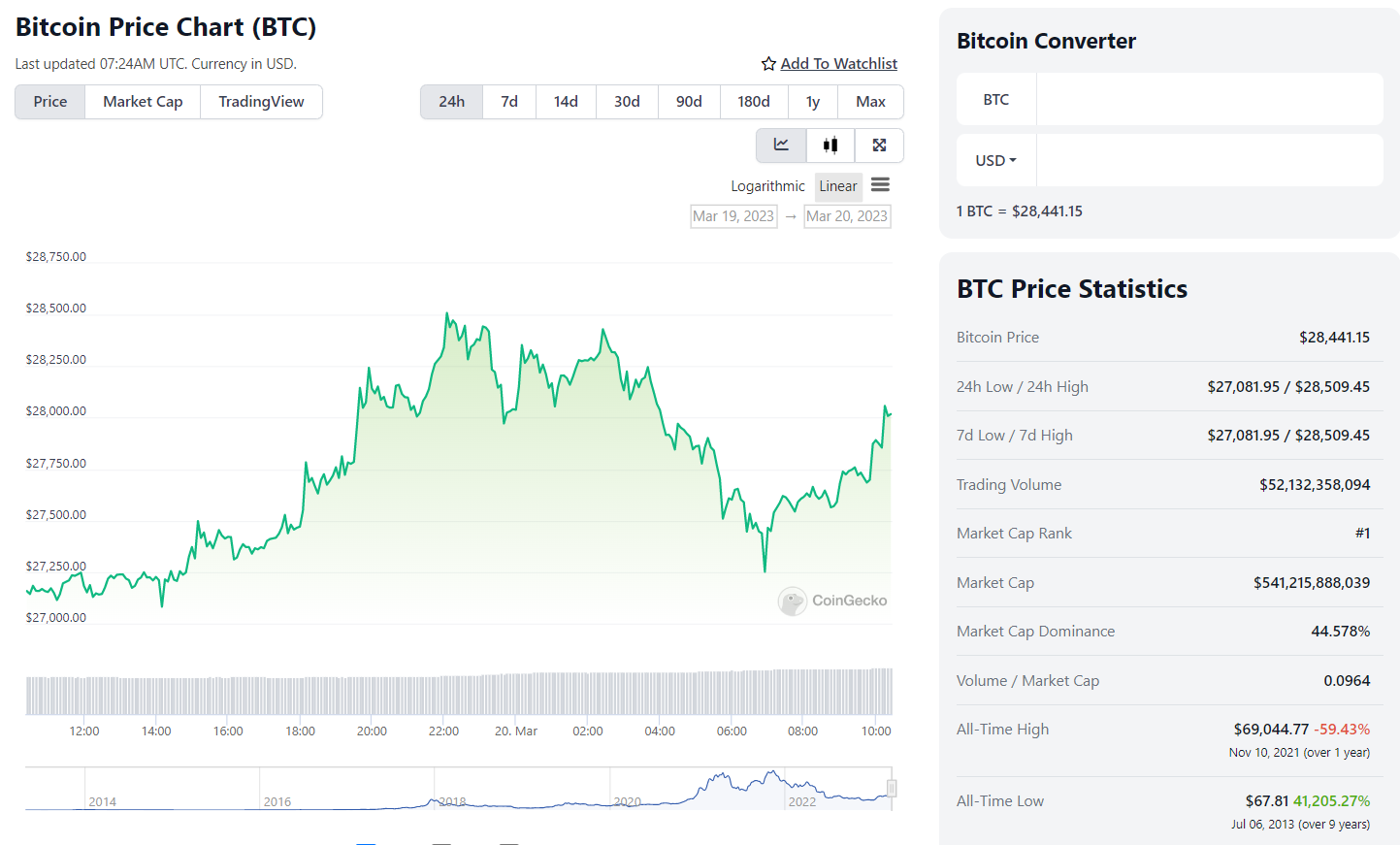

Bitcoin market price analysis

BTC experienced a brief bearish dip as it hit the $26,588 support level. However, the bulls quickly regained control and pushed the price to higher levels through solid buying pressure.

At the time of writing, bitcoin (BTC) is trading at $28,011.22, and over the last 24 hours, it has recorded a 3.30% price increase with a trading volume of $52,142,363,473.

The past week has been bullish for BTC, with a significant price increase of 26.75%.

Currently, market capitalization of bitcoin stands at $541,215,888,039 against a total circulation of 19 million coins.

These figures demonstrate a strong performance by bitcoin in both the short-term and long-term, indicating a potential trend of positive growth for the world’s largest cryptocurrency.

The recovery of BTC is underway after the recent dip, and the buying pressure is helping to sustain the upward momentum.

Bitcoin touched a support level of $26,899, and the bulls were able to defend it successfully, indicating a potential continuation of the current bullish trend.

The next significant resistance level for BTC stands at $28,044, and if the bulls can maintain their current strength and overcome this hurdle, the price could surge even higher.