Recent data shows that whales have become active again. CryptoQuant analyst, who goes by the pseudonymous name SingleQuant, calls it the whale accumulation stage.

The prices are still low and might look attractive for the whales to accumulate. The analyst believes that the whales have been stacking their assets on futures exchanges due to a lack of liquidity and to drive the price up.

You might also like: SUSHI tumbles amid whales unstaking tokens

Moreover, CryptoQuant’s analyst expects higher volatility in the crypto market since whales might be able to manipulate the prices.

As the whale activity in the derivatives market rises, the largest crypto exchange by trading volume, Binance, saw a roughly $6 billion rise in its derivatives trading volume, according to data provided by CoinMarketCap (CMC). At the time of writing, the number has climbed to $60.8 billion, a 10.6% increase in the past 24 hours.

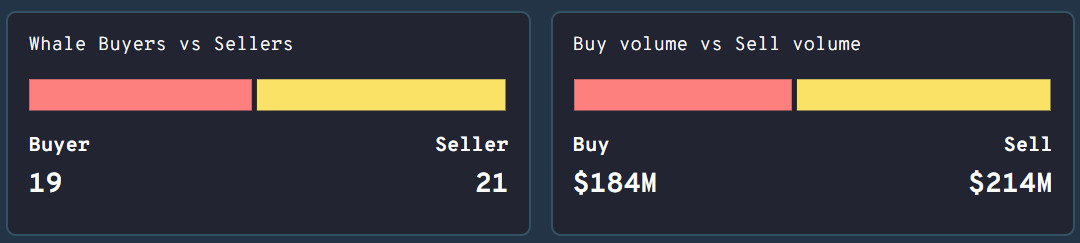

Furthermore, WhaleStats data shows that the number of sellers among the top 100 Ethereum whales is higher than that of buyers. Per the data, the selling volume of the whales has reached $214 million while the purchasing volume is $30 million below, at the $184 million mark.

WhaleStats data shows the rise in whale activity started on March 27, surging to over $393 million from $70 million the day before.

Read more: US CFTC takes legal action against Binance