Crypto enthusiasts on social media have expressed concerns about soaring bitcoin (BTC) transaction fees and a growing backlog of unconfirmed transactions, prompting speculation about a potential denial-of-service (DoS) attack on the network.

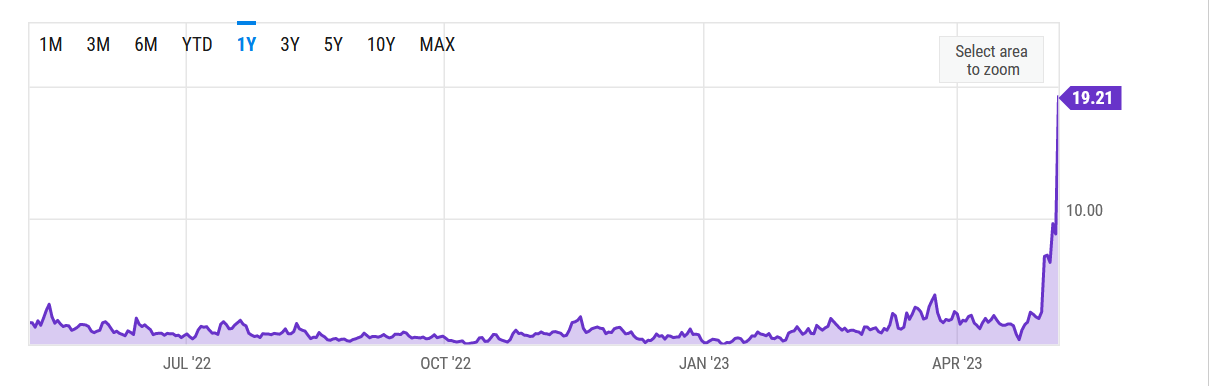

Over 424,000 transactions await confirmation in bitcoin’s mempool, with the average transaction fee reaching $19.21, an increase of over 750% in a year.

While some users suspect malicious intent behind the network congestion, others attribute the clogged mempool to the increasing popularity of BRC-20 tokens and Ordinals inscriptions, which have experienced a surge in quantity and trading volume.

The bitcoin community has swiftly dismissed these apprehensions, identifying the heightened demand and transaction volume as the primary cause. The recent expansion of Ordinals inscriptions and BRC-20 minting has contributed to the surge in network traffic.

Price volatility amid network congestion

Binance, the world’s major cryptocurrency exchange, has temporarily suspended bitcoin transactions twice within 12 hours due to the substantial volume of pending transactions. The exchange has also elevated its BTC withdrawal fees to address the backlog.

Concurrently, bitcoin’s price has fluctuated, declining by 3% over the past 24 hours to approximately $28,000 as of May 8. Binance has since resumed BTC withdrawals, attributing the suspension to the large volume of pending transactions.

To address ongoing network congestion, Binance is working to enable withdrawal through the Lightning Network, a layer-2 solution that allows quicker and more cost-effective transactions.

The exchange aims to alleviate similar issues in the future, ensuring a smooth experience for its users despite the network’s fluctuating demands.

The influence of BTC Ordinals on network strain

The swift increase in Ordinals inscriptions has significantly impacted the bitcoin network, escalating transaction fees and unconfirmed transactions.

Ordinal inscriptions, a byproduct of bitcoin’s taproot upgrade, are metadata attached to specific transactions. This innovative protocol permits users to mint NFT-like assets, referred to as inscriptions, on the bitcoin blockchain.

The growing interest in BRC-20 tokens, an experimental token system built atop bitcoin, has further intensified the congestion. Nevertheless, the upsurge in demand demonstrates the burgeoning popularity and diverse applications of bitcoin.

Navigating the path forward

Despite concerns about a potential DoS attack on the bitcoin network, the current landscape can be ascribed to the growing demand for BRC-20 tokens and Ordinals inscriptions.

As the bitcoin network continues to grapple with congestion and elevated transaction fees, investors must remain informed and exercise prudence.

Monitor network metrics, stay abreast of reputable news sources, and explore alternative solutions like layer-2 networks for expedited and cost-effective transactions.

Above all, maintain vigilance in assessing market sentiments and potential risks before making investment decisions.