Tether International Limited (Tether), the manager of the popular stablecoin, has unveiled a new investment strategy for its reserves portfolio.

The company will allocate a portion of its net realized operating profits, up to 15%, towards acquiring bitcoin (BTC) on a regular basis.

Holding steady at third

In a statement released on May 17, Tether outlined its investment approach, emphasizing its focus on utilizing realized profits.

The company made it clear that any unrealized capital gains resulting from price increases would be disregarded, ensuring that only concrete gains from its operations would be considered.

Currently, the company holds approximately $1.5 billion in BTC in its reserves as of the end of March 2023. However, unlike institutional investors, Tether follows a different approach, taking possession of the private keys associated with its bitcoin holdings.

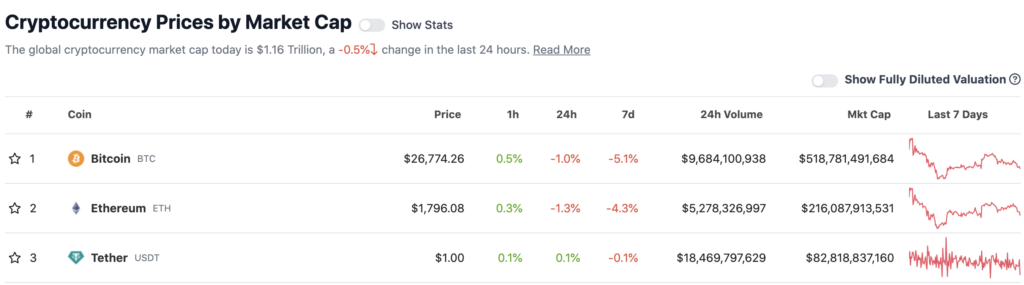

This decision comes in the midst of ongoing scrutiny surrounding the transparency of its reserves; Tether’s stablecoin (USDT) holds the notable position of being the third-largest digital asset globally, trailing behind bitcoin (BTC) and ether (ETH).

According to data from CoinGecko, USDT boasts a total market capitalization of $82.8 billion.

The bitcoin philosophy

Per a Tether press release from March:

“Bitcoin has continually proven its resilience and has emerged as a long-term store of value with substantial growth potential. Its limited supply, decentralized nature, and widespread adoption have positioned Bitcoin as a favored choice among institutional and retail investors alike. Our investment in Bitcoin is not only a way to enhance the performance of our portfolio, but it is also a method of aligning ourselves with a transformative technology that has the potential to reshape the way we conduct business and live our lives.”

Paolo Ardoino, the chief technology officer of Tether.

Tether is not the first company to take this approach. Despite selling some of its bitcoin holdings for tax purposes in December, MicroStrategy, the business software company known for its affinity for cryptocurrency, also remains a staunch supporter of bitcoin.