MakerDAO, an Ethereum-based DeFi protocol, is preparing for a crucial vote on a proposal to increase the Dai stablecoin (DAI) savings rate (DSR) to 3.33%. If implemented, this change would likely have far-reaching effects on borrowing rates across the DeFi sector.

The Maker team recently tweeted that a new DAI Savings Rate (DSR) hike, from 1% to 3.33%, will be initiated by a future executive vote.

The Maker Protocol ecosystem relies heavily on the DSR, which allows users to deposit DAI and receive a fixed interest rate. This interest is calculated instantly as a percentage of the system’s takings.

Block Analitica, a risk management consultancy focusing on DeFi and a MakerDAO risk core unit team member, has proposed raising the DSR and changing the stability costs on certain forms of collateral. Users that borrowed DAI against collateralized assets like ether (ETH) and wrapped BTC (WBTC) pay stability fees to fund the DSR.

The DSR is a crucial monetary lever in maintaining a healthy supply and demand for DAI. It encourages or discourages users from committing their DAI to DSR contracts. MakerDAO stresses the need for frequent DSR adjustments to accommodate fluctuating Dai market circumstances.

Primoz Kordez warns of fee increase

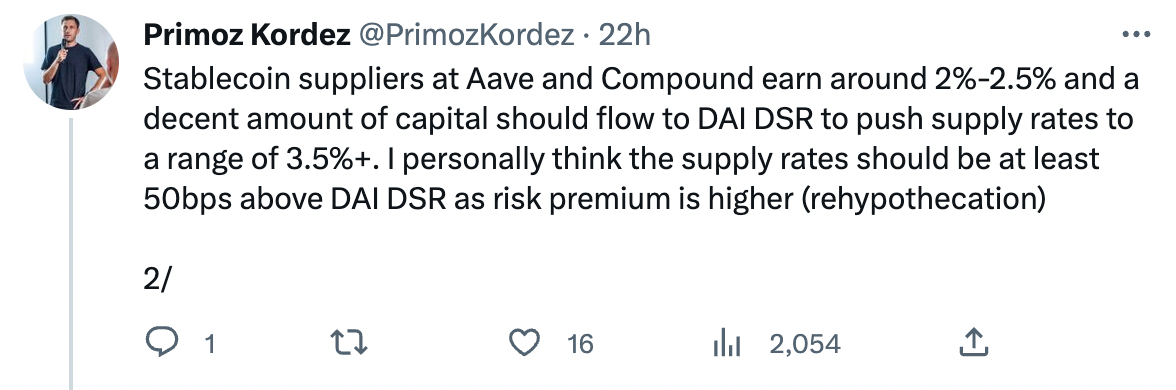

Block Analitica’s creator, Primoz Kordez, gave the plan further background and cautioned the community to brace for a fee increase in DeFi.

He elaborated on how the new higher DAI DSR of 3.33% will affect rates throughout the DeFi market. Supply rates for stablecoins on exchanges like Aave and Compound are between 2% and 2.5%, but Kordez expects it to rise as more money flows into DAI DSR.

After a prior increase to 1% in December 2022, when DSR contracts saw an inflow of 35 million DAI within a month, the proposal to raise DSRs again seems understandable. MakerDAO has a dynamic monetary policy and uses the DSR to keep DAI’s supply and demand in equilibrium.

Community members of MakerDAO are getting ready to vote on a proposal that may have far-reaching effects on not just interest rates and yield chances inside the MakerDAO ecosystem but also the more significant DeFi sector. DeFi consumers are interested in stablecoin returns may find DAI a more appealing choice if the proposal is adopted.